BYPL SASHAKT Scholarship 2024-25

June 17, 2025

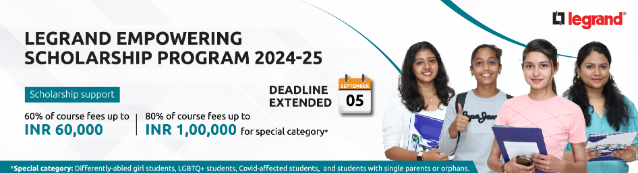

Selected candidates can avail themselves of the following benefits:

For Applicants:

June 17, 2025

June 17, 2025

June 17, 2025

June 17, 2025

June 17, 2025

June 17, 2025

June 17, 2025

June 17, 2025

June 17, 2025

June 17, 2025